Cheyenne Credit Unions: Discover the Best Neighborhood Banking Providers

Cheyenne Credit Unions: Discover the Best Neighborhood Banking Providers

Blog Article

Discover the Advantages of Federal Lending Institution

Federal cooperative credit union use a riches of benefits that accommodate the demands of their participants in such a way that typical banks usually overlook. From competitive rates of interest to customized customer care, the advantages of becoming part of a federal lending institution surpass simply monetary transactions. These establishments prioritize member fulfillment and community participation, creating an one-of-a-kind banking experience that places people initially. By exploring the benefits of federal credit report unions, you could discover a monetary landscape that lines up more closely with your worths and objectives.

Subscription Advantages

One more significant advantage of membership in a federal lending institution is the opportunity to take part in decision-making processes. Unlike financial institutions, lending institution operate as not-for-profit companies had by their members. This autonomous framework enables participants to vote on crucial problems and elect the board of supervisors, guaranteeing that the cooperative credit union remains liable to the neighborhood it offers.

Reduced Prices and charges

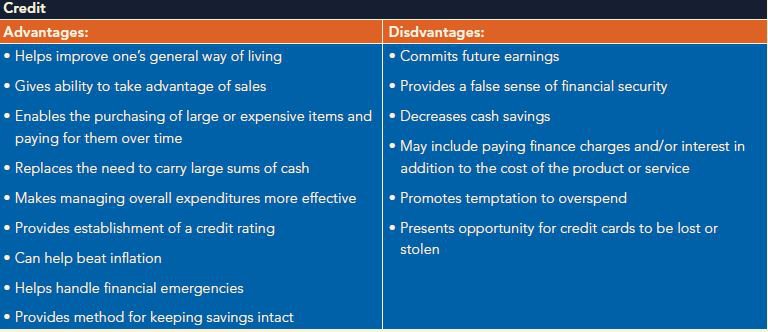

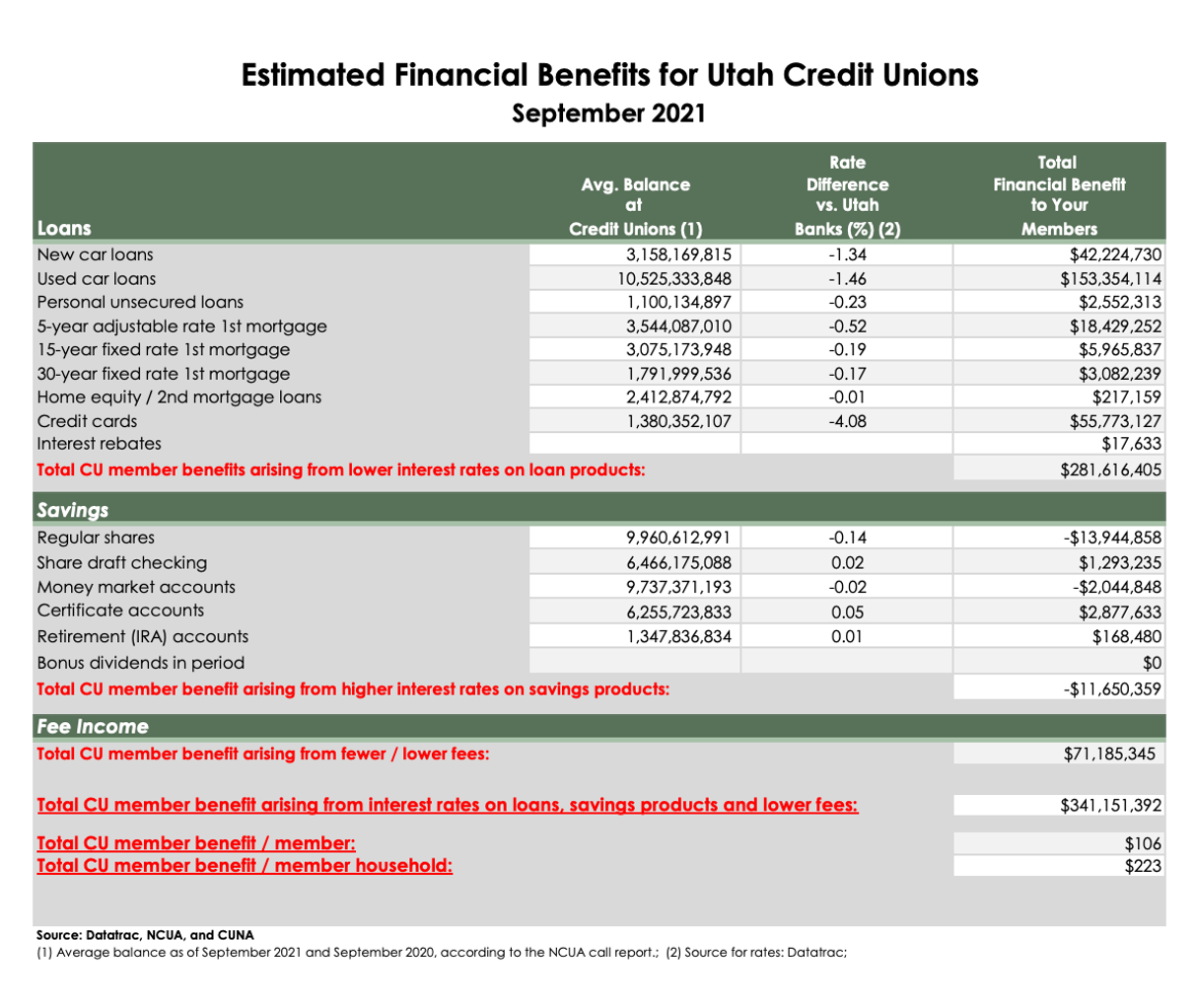

Federal credit rating unions are known for their affordable prices on fundings, credit scores cards, and financial savings accounts. In addition, debt unions are not-for-profit organizations, suggesting they focus on serving their participants rather than maximizing revenues. Overall, the lower costs and rates supplied by federal credit unions add to an extra economical and economically advantageous financial experience for their participants.

Personalized Financial Services

How do lending institution separate themselves by using personalized economic services tailored to individual member requirements? Federal lending institution master this facet by prioritizing the one-of-a-kind demands of each participant. Unlike standard financial institutions, lending institution are member-owned and ran, allowing them to concentrate on personalized solution as opposed to profit maximization. Participants have the opportunity to take a seat with monetary experts who put in the time to comprehend their details objectives, whether it's saving for a home, planning for retirement, or combining debt.

Customized economic solutions at cooperative credit union extend past simply fundamental financial demands (Credit Unions Cheyenne). Members can access customized financial investment guidance, insurance coverage products, and even estate planning services. This tailored approach develops a feeling of depend on and commitment between members and their lending institution, promoting long-term connections constructed on good understanding and support

Community Involvement Opportunities

Involving with local neighborhoods, lending institution supply varied possibilities for participants to proactively take part in various area participation efforts. These initiatives can range from volunteering at neighborhood occasions, organizing charity drives, taking part in economic proficiency programs, to supporting regional companies. By actively participating in community involvement opportunities, cooperative credit union members not just add to the betterment of their communities however also foster strong partnerships with other community participants.

One substantial facet of area participation with credit scores unions is the emphasis on economic education. Lending institution commonly conduct workshops and workshops on different financial topics, such as budgeting, saving, and investing, to equip members with the understanding to make audio financial choices. Additionally, credit score unions often team up with regional schools and companies to This Site promote economic proficiency among students and young grownups.

Access to Nationwide Atm Machine Networks

Accessibility to Nationwide Atm Machine Networks is a crucial benefit used by government cooperative credit union, giving members with convenient access to a vast network of Atm machines throughout the nation. This benefit guarantees that members can easily access cash money and carry out purchases anywhere they may be, whether they are taking a trip for service or enjoyment. Federal credit score unions usually take part in nationwide atm machine networks such as CO-OP Network, Allpoint, or MoneyPass, permitting their members to utilize thousands of ATMs without incurring additional costs.

Conclusion

Finally, federal lending institution supply participants different benefits, including competitive rate of interest, lower fees, customized economic services, and chances for neighborhood involvement - Credit Unions Cheyenne WY. By prioritizing member requires over revenues, credit history unions give an one-of-a-kind and tailored strategy to financial solutions. With access to across the country ATM networks and democratic decision-making procedures, members can gain from a customer-focused and community-oriented banks

One vital benefit of being a participant of a federal credit history union is accessibility to competitive rate of interest rates on savings accounts, fundings, and credit history cards. Federal credit history unions are recognized for their affordable rates address on loans, anonymous credit rating cards, and financial savings accounts. By proactively engaging in community involvement opportunities, credit history union members not just add to the improvement of their areas yet also foster strong partnerships with other neighborhood members.

Debt unions usually perform workshops and seminars on different economic subjects, such as budgeting, conserving, and investing, to equip participants with the expertise to make sound economic choices.In conclusion, government credit history unions use members various advantages, including affordable rate of interest prices, reduced costs, customized financial services, and opportunities for neighborhood involvement.

Report this page